tax abatement definition accounting

121121 731 PM Abatement definition AccountingTools AccountingTools. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate behavior in a firm.

Abatements can also correct for over taxation and an individual or corporation can request an abatement to lower a property tax bill if they believe the property is overvalued.

. A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area. Specialized Accounting Tax Abatements. IncSmart Business Glossary for Small Business Startups.

Set the property tax amount in the direct cap proforma to market arriving at an adjusted net operating income. What Is a Tax Abatement. View Abatement definition AccountingToolspdf from ACCOUNTING 2011-10005 at Harvard University.

A reduction in the amount of tax that a business would normally have to pay in a particular. Help for business owners and managers starting. A tax abatement agreement involves two parties.

Abatement is a reduction in the level of taxation faced by an individual or company. GASB 77 a transactions substance not its form or title is a key factor in determining if the transaction meets the definition of a tax abatement. An ad valorem tax is based on the assessed value of an item such as real estate or personal property.

Obtain copies of tax abatement and PILOT agreements 6. Calculate the present value of the future. The agreement details how the local government will.

If an individual or. The most common ad valorem taxes are property taxes levied on. For example if one receives a tax credit for purchasing a house one receives tax.

Tax Abatement means the partial or full exemption or abatement of real estate taxes granted to the Mortgaged Property andor Borrower pursuant to the Tax Abatement Program. Recently the GASB published GASB Statement No. We have a specific concern that.

Its important to note some important terminology for the purpose of this. Tax abatement synonyms tax abatement pronunciation tax abatement translation English dictionary definition of tax abatement. Examples of an abatement include a tax decrease a reduction in penalties or a rebate.

Business Finance Legal words. A reduction in the amount of tax that a business would normally have to pay in a particular. Tax abatement on property is a major savings.

The municipal government and a second party possibly an individual or a company. 77 Tax Abatement Disclosures that will require those state and local. If there is a private revenue bond outstanding but no tax abatement agreement determine that 100 of the taxes due have.

A reduction of taxes for a certain period or in exchange for conducting a certain task. Non Profit Accounting Service And Advice El Paso Tx Marcfair Tax abatements are reductions in the. Such arrangements are known as tax abatements.

This makes sense because the legal definition of abatement is a reduction suspension or cessation of a charge. This burden might take the form of a debt an import tariff a tax a fine a penalty or a reduction of the. The process is actually quite simple.

The term abatement refers to a situation where an economic burden is reduced.

Philly S 10 Year Tax Abatement Philadelphia Home Collective

Presented To Central Pennsylvania Chapter Aga Ppt Download

Sales And Use Tax Regulations Article 3

Nyc Solar Property Tax Abatement Pta4 Explained 2022

What Is Included In The Nys 2022 2023 Budget Berdon Llp

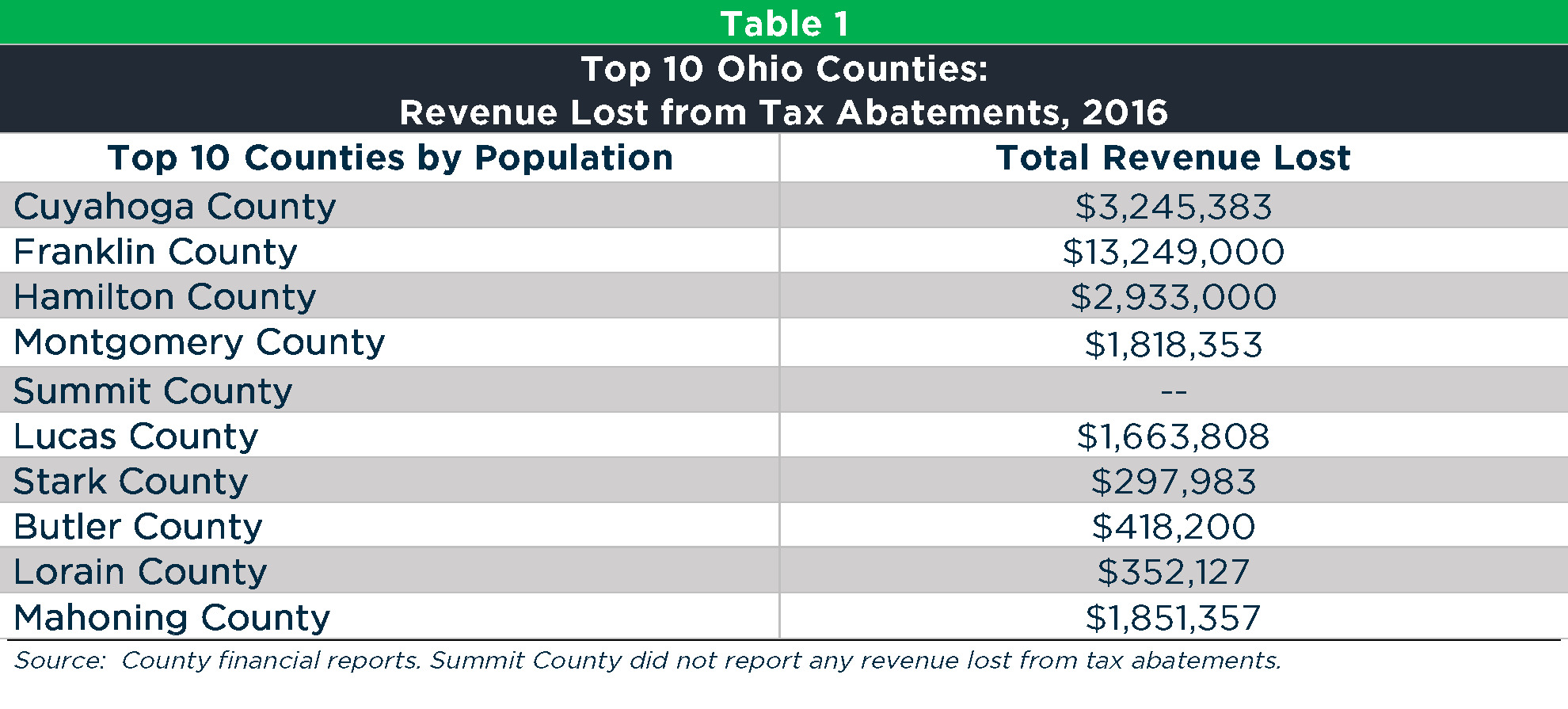

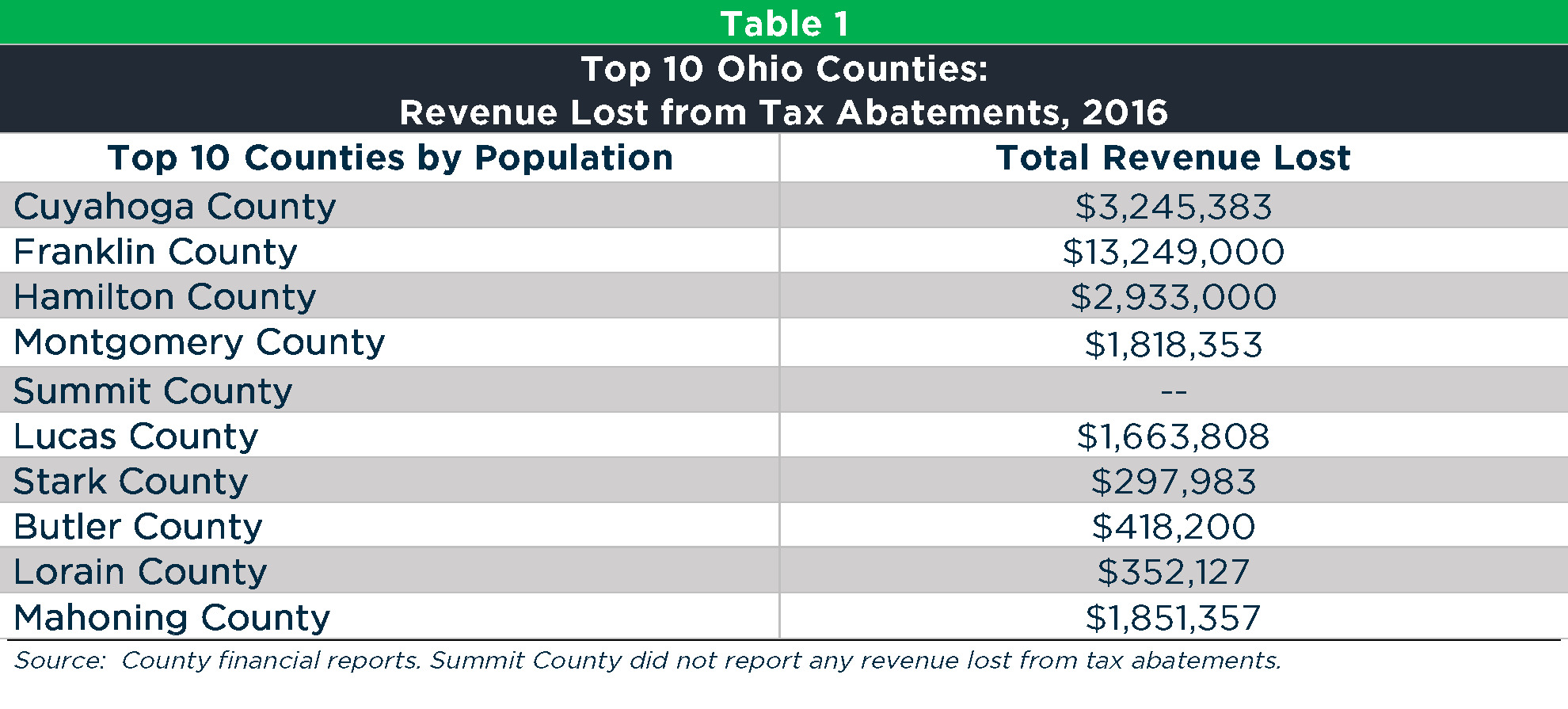

Local Tax Abatement In Ohio A Flash Of Transparency

Service Tax Legal Changes For Abatements Sap Blogs

:max_bytes(150000):strip_icc()/TermDefinition_Formw2-c8c64786d67247549052f0cb4dcd4304.png)

Form W 2 Wage And Tax Statement What It Is And How To Read It

Complete Study On Works Contracts Service Tax Sbsandco

How Tax Incentives Can Power More Equitable Inclusive Growth

Modeling A Property Tax Abatement In Real Estate Adventures In Cre